The legalities of the situation are this: although the company is headquartered in Minnesota, they have a presence in California and so technically I should have been charged sales tax by the vendor. Since they didn't, it is now technically my responsibility to pay the equivalent amount in use tax. The sales tax rate varies depending on exactly where you live but in my case it's 8.25%. So the amount due is $2.05.

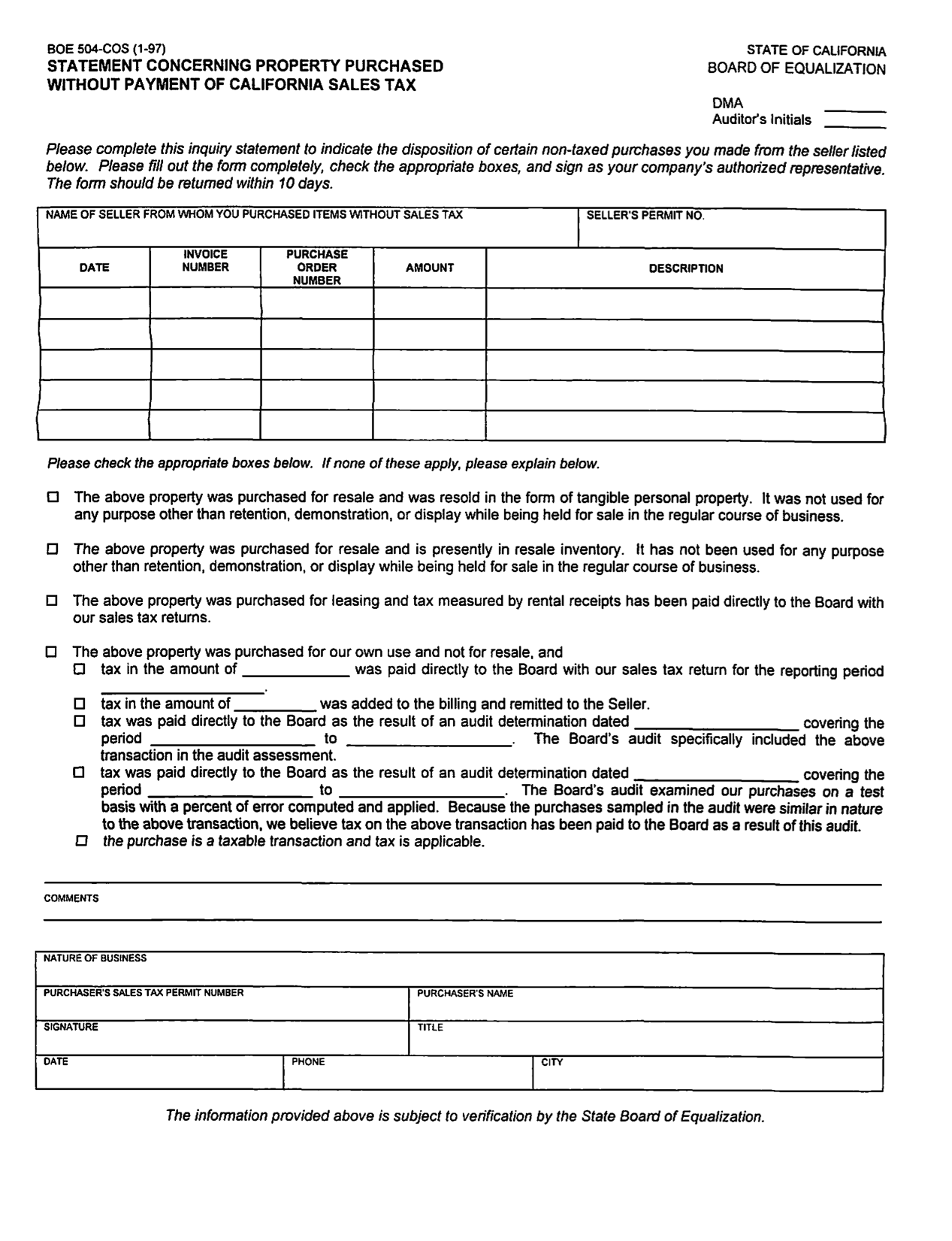

Which I would happily pay. The government where I live actually works pretty well, and I'm happy to pay my fair share to keep it up and running. But the problem is this: this particular vendor normally doesn't sell to consumers, they sell to small businesses, in which case no sales tax is due. So instead of just paying the $2.05 and charging it to my credit card, they want me to fill out this form:

Let's do a little math here. There are at least three human beings involved in this process: me, whoever at the company has to process the form when I send it back, and the auditor. Let's suppose that we each bill at $60 an hour, and that it takes each of us one minute to do our respective task in this little bit of economic kabuki theatre. So we have just effectively spent $3 to generate $2.05 worth of tax revenue.

This is another example of the societal failure to understand the difference between money and wealth. Somewhere in the government some bureaucrat has been charged with the task of collecting the money which the state is legally due with (apparently) no regard for the cost of doing the collecting. So the government will get its $2.05, but society will be $3 poorer for it. At least.

If this were an isolated incident it would not even be worth the bother to write about. But it isn't. This sort of short-sightedness pervades American society at every level, from people who choose their credit cards on the basis of which ones give them the most frequent-flyer miles to the weenies of Wall Street who continue to promulgate the myth that everyone can get rich by playing the stock market. (Hey, it worked for them, didn't it?)

And now I have to stop writing because I need to fill out this stupid form.

What would happen if you don't fill that form?

ReplyDeleteProbably nothing. But it could put me on the radar screen for an audit, which would cost me even more time than filling out the form.

ReplyDeleteHow would IRS know that you didn't pay sales tax?

ReplyDeleteIf you don't report it - what would raise the audit flag.

Not the IRS, the Cailfornia Board of Equalization (which is California's Orwelian equivalent of the IRS).

ReplyDelete